UPS has announced an average general rate increase of 5.9% that will go into effect December 26, 2023. Noteworthy is that the increases are generally smaller than in last year’s GRIs, while being similar in many ways to FedEx’s upcoming increases.

The highlights of the 2024 UPS GRI include:

- The continued correlation between inflation and GRIs

- With the exception of 3 Day, 2024 will experience similar increases to 2022 when inflation was in line with the present

- With the exception of Ground, all Domestic Minimums are increasing by more than the headline 5.9% average amount (but not by much)

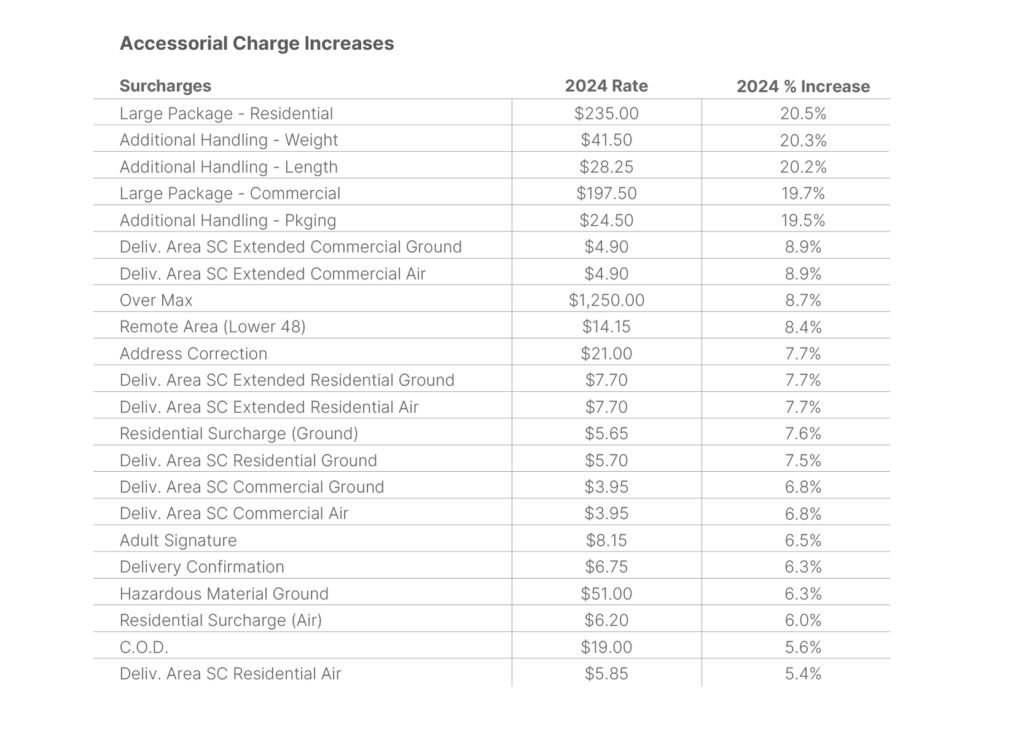

- Large Package surcharges, Additional Handling surcharges, and Saturday Stop charges are increasing the most compared to other surcharges and fees

Remember, surcharges are not included in the 5.9% GRI figure, and most customers will see increases in 2024 far greater than that headline percentage. It’s vital that companies look deeper into the increases to understand how much their costs will be going up in 2024 in real terms.

UPS: The Business

Although UPS has appeared to have weathered the ups and downs of the post-pandemic marketplace from both a financial and service performance perspective better than FedEx, the carrier still needs to play some catchup. UPS lost business as a result of its difficult labor negotiations this year and is dealing with challenging market headwinds with less overall package volume available to carriers. This means UPS will be working hard to win back business and bring additional “new” volume into its network in 2024.

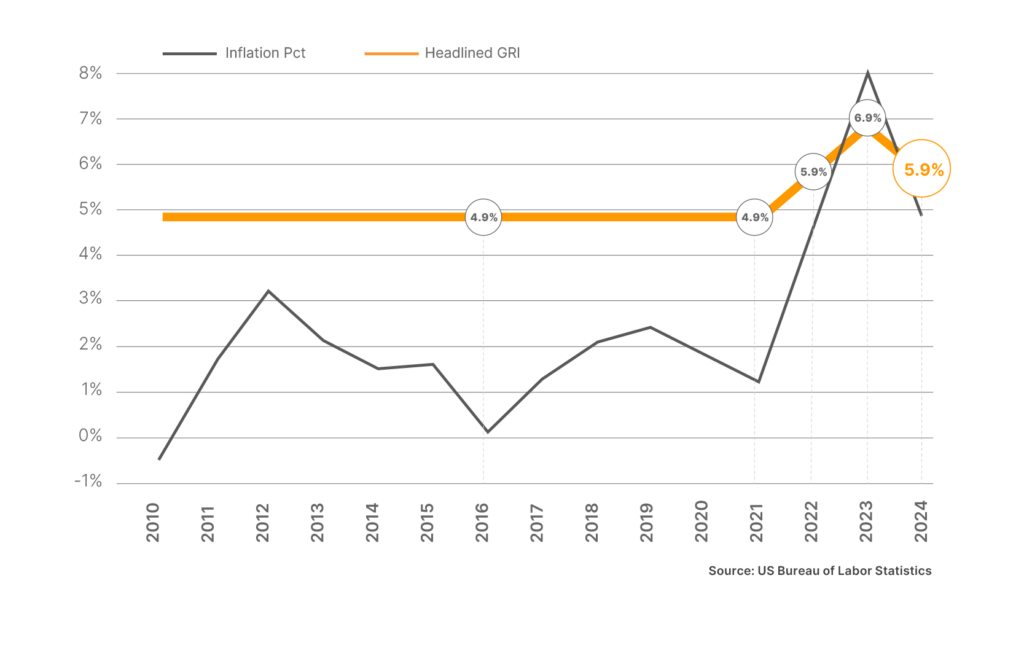

Illustration 1: Inflation vs. Average GRI

Inflation and the UPS GRI have aligned closely over the years and, not surprisingly, the 2024 GRI will resemble the 2022 increases more than those of 2023.

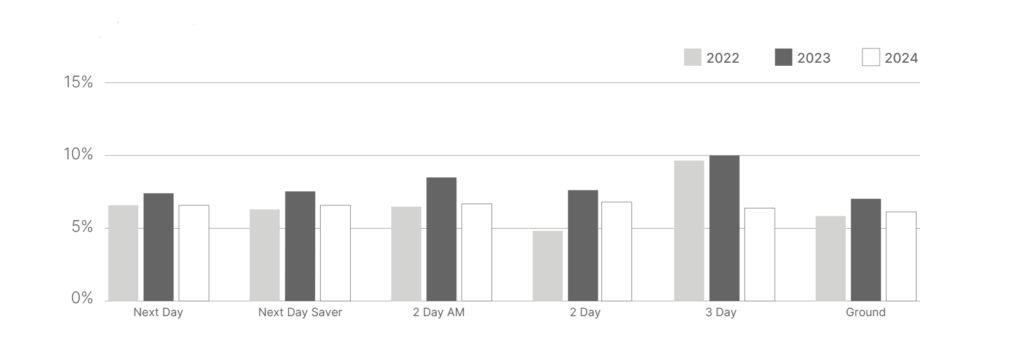

Illustration 2: Average Services Increases by Year

Service increases are softer in 2024 than in 2023 and closely follow the 2022 increases, with the exception of 3 Day Select, which is facing a much smaller increase.

Like FedEx, UPS is looking to drive more revenue from surcharges and fees, as opposed to emphasizing service rate increases.

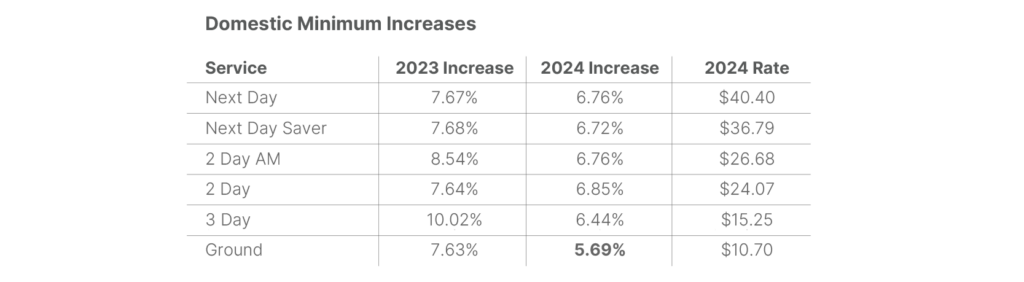

Illustration 3: Service Minimum Increases YoY

The only Domestic Service Minimum increasing less than 5.9% is Ground. This is a slight surprise given the continued steady growth of ecommerce. The 2024 increases are in a much tighter range (and lower) than 2023 across the board.

Illustration 4: Surcharge Increases

Large Package and Additional Handling surcharges (a.k.a. “bulky” and “ugly” shipments) are taking the brunt of the increases in 2024. Interestingly, Delivery Area surcharges were a big focus in 2023 with 10%+ increases, but are now close to the average.

Illustration 5: Saturday Stop Fees

Illustration 5: Saturday Stop Fees

With weekend deliveries growing in popularity, UPS has been more creative by providing some “smart” options to customers. It’s no surprise that Saturday Stop Fees are increasing — but noteworthy is that the percentage amounts are among the highest anywhere in the GRI.

Recommendations and Takeaways

Despite a relatively positive past few years compared to FedEx, UPS finds itself in a less favorable position compared to where it was. Like FedEx, UPS needs more package volume and revenue.

To that end in 2024, UPS is again taking aim at bulky packages with its GRI, among a few other surcharge-related areas (e.g., Large Package surcharges, Additional Handling surcharges, and Saturday Stop Fees). As with FedEx, UPS customers should be aware that exposure to surcharges will continue to drive the largest cost increases.

And, here is another reminder that surcharges are not included in the headline GRI amounts, nor are they capped — even for companies with rate cap clauses in their agreement. Carriers always retain the ability to add, remove, or change surcharges basically at their discretion.

Lastly, it is important to note that no changes to Postal rates have been announced as of yet.

Our Recommended Call to Action: UPS customers need to start planning their parcel shipping budgets for 2024, and analyzing your shipping spend in light of the details in this report is a good first step in doing so. Here are two actions shippers can take right now:

1 – Renegotiate. The time to renegotiate your contracts has never been better than it is right now, with both carriers competing for shrinking parcel volume.

2 – Make Better Decisions. Leveraging the parcel data your company is already generating every day is the most effective way to figure out how the GRIs will change your costs and develop actionable steps to improve your shipping operations to help offset potential increases.

Here are relevant links from the UPS website:

https://www.ups.com/assets/resources/webcontent/en_US/Daily_US48_Preview.pdf

https://www.ups.com/assets/resources/webcontent/en_US/Accessorial_Preview.pdf

https://www.ups.com/us/en/support/shipping-support/shipping-costs-rates.page