After a challenging 18 months for the entire supply chain industry, small parcel shippers will appreciate having a clearer view of the rate landscape for the balance of 2021, thanks to the recent Peak Season Surcharge announcements from both carriers.

No one is a fan of the surcharges, of course, but at least shippers can understand what their costs will be with a little homework.

The parcel experts at TransImpact have dug deep into both carrier’s updates and identified the details we think are most important for shippers like you to make a note of. The cost implications for a lot of companies are significant, and understanding how they’ll affect yours can be nuanced, so taking the time to be sure of how your small parcel shipping costs will be impacted this peak shipping season should be a priority for everyone.

But First the Facts

There are some similarities to past Peak Season Surcharge announcements from recent years. The most obvious and least surprising is that both UPS and FedEx followed similar themes of emphasizing surcharges on bulky and large packages and residential shipments.

The timing is nearly identical, too, with Peak Season for both UPS and FedEx lasting for 15 weeks starting the first week of October and running through the second week of January. FedEx’s are in place from October 4 to January 16, with UPS implementing its Peak Surcharges October 3 to January 15.

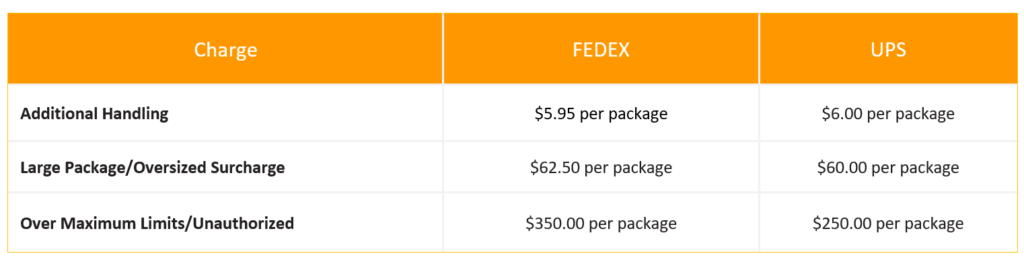

And, in what’s become an unwelcomed holiday tradition, UPS and FedEx will again be charging extra for Additional Handling, Large Package/Oversized shipments, and Over Maximum Packages as they have done since 2017. One subtle difference in their approaches is that UPS gives very small shippers a break from the charges. Only companies shipping more than ten packages per week subject to those charges or have shipped over 1,000 since February 2020 will pay the extra charges. FedEx, on the other hand, will apply surcharges to all qualifying packages entering their network.

Comparing the Peak Surcharges from FedEx and UPS

The differences between the surcharges become apparent with a closer look. As the following illustration highlights, FedEx has a slightly cheaper Surcharge for Additional Handling ($5.95) compared to UPS ($6.00). However, UPS shippers will pay smaller surcharges on Large Package ($60.00) and Over Maximum charges ($250.00) compared to FedEx at $62.50 and $350.00 respectively.

Like last year, FedEx and UPS will take a tiered approach to Residential Peak Season Surcharges with both using a shipper’s February 2020 average shipment volume to calculate the peak charge that will be applied. Unlike UPS, however, FedEx leaves open the possibility for enterprise shippers to avoid these charges during certain weeks during peak if they can hold volume during those set periods.

Notable to FedEx shippers is that customers who average more than 25,000 Residential and Ground Economy (the total for FedEx Express and U.S. Domestic Ground) packages weekly from October 4 to October 17 will incur the Peak – Residential Delivery Charge from November 1 to December 12. The same will apply for the weeks of November 15 to November 28, with the charges applied from December 13 to January 16, 2022.

UPS will apply its charges to UPS Air Residential, UPS Ground Residential, and UPS SurePost packages for all U.S. domestic shipments sent by qualifying customers who have shipped more than 25,000 packages during any week following February 2020.

UPS and FedEx have similar Residential Peak Surcharges; however, large FedEx shippers whose volume increased over 500% will pay $1.15 less on Express shipments than UPS. See the following illustration for more details.

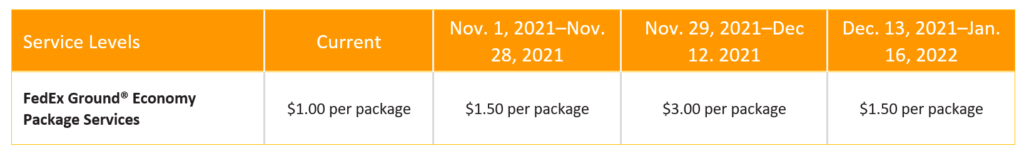

And, while UPS is also taking a tiered approach to its SurePost service, only making it applicable to shippers with a volume of over 25,000 weekly packages, FedEx Ground Economy shipments will incur the charge regardless of volume. Prior to November 1, the FedEx Ground Economy Peak Season Charge is $1.00. It will then increase to $1.50 leading up to Thanksgiving, with a bigger jump to $3.00 from November 29 to December 12. Then, it will return to $1.50 through January 16, 2022.

Looking Forward

A final difference between the UPS and FedEx announcements is that FedEx indicated the continuation of Peak Surcharges well into 2022.

This means that beginning on January 17, 2022, FedEx customers who shipped more than an average of 25,000 Residential packages weekly (excluding FedEx One Rate) and FedEx Ground Economy (the total for FedEx Express and U.S. Domestic Ground) during either of the Peak Season Calculation Periods will be charged an additional $0.60 per package Residential Delivery Charge. And note, while FedEx Ground Economy packages will contribute to the package count during the applicable weeks, FedEx Ground Economy packages will not be charged the $0.60 peak surcharge beginning on January 17, 2022.

By comparison, UPS stated in their Q2 earnings call that the peak environment would end in 2022 and that they did not plan to continue these “temporary” surcharges.

What Should You Do Next?

Two crucial periods are coming up for FedEx shippers: October 4 through October 17 and November 1 through December 12. During these weeks, the Peak – Residential Delivery Charge will be applied. As a tactic to mitigate some of these additional costs, our advice is to consider using regional carriers during this time. Putting a plan in place to do so will take work, but it could be well worth the effort. If you have established carrier relationships and are already diversifying your parcel volume, consider diverting more of it to regional carriers during these periods for relief from some peak surcharges. This is not to say shippers must avoid FedEx and UPS for every shipment during crucial holiday shipping periods, but this type of strategy may help it be less costly.

Having a conversation with your carriers can be another avenue towards some relief. To start, consider the carriers’ differences and your company’s long-term peak exposure. It’s worth asking, for example, if your traditional surcharge discount, such as my Additional Handing Surcharge (AHS) discount, applies to AHS Peak Surcharges. And if it doesn’t, why not?

Another question that every UPS customer that has shipped over 25,000 packages in a week at any point in the past 18 months can ask is, should we really be accountable to pay Peak Surcharges in Q4 of 2021? It’s possible you’ve had abnormal volume spikes due to COVID, or maybe a surge of backorders. If so, it’s fair to ask if it is reasonable to be punished for the remainder of the year, especially considering that if you were a FedEx shipper that might not be the case.

We have two final suggestions.

One, make sure you understand how these surcharges will impact your shipping costs in Q4. There is urgency to do this as soon as possible for obvious reasons. TransImpact will perform a no-obligation analysis to show you exactly what these new charges will cost you.

And lastly, take a closer look at your parcel data to identify other ways unnecessary parcel costs are hurting your bottom line. TransImpact offers simple Parcel Spend IntelligenceTM tools that will provide immediate and actionable insights that will optimize your entire parcel shipping network.

Email info@transimpact.com to learn more.