Read our breakdown to learn how to mitigate the impact of 2022’s peak surcharges.

Calculating a parcel shipment’s cost has never been simple, but it’s more complicated than ever with all the potential surcharges and fees that FedEx and UPS have in place.

Since the beginning of the pandemic, various new charges have come and gone from the carriers — with some still on the books to this day. These have included so-called “peak” surcharges applied year-round to small parcel shipments domestically and internationally.

But we’re approaching the time of year when things get complicated further by yet another additional cost — confusingly referred to as “Holiday” or “Demand” peak surcharges. Most shippers will know it’s become common since 2018 for UPS and FedEx to add seasonal peak surcharges focused on an ever-broadening window around the holiday season when shipping demand peaks.

While there are similarities in the types and amounts of many demand surcharges between UPS and FedEx, there are many contrasts, too. These differences can add to shippers’ confusion when budgeting for how the additional charges will impact their businesses.

TransImpact created this report to help you understand the current state of peak surcharges from FedEx and UPS and provide the necessary information to measure the cost impact during 2022’s peak holiday season.

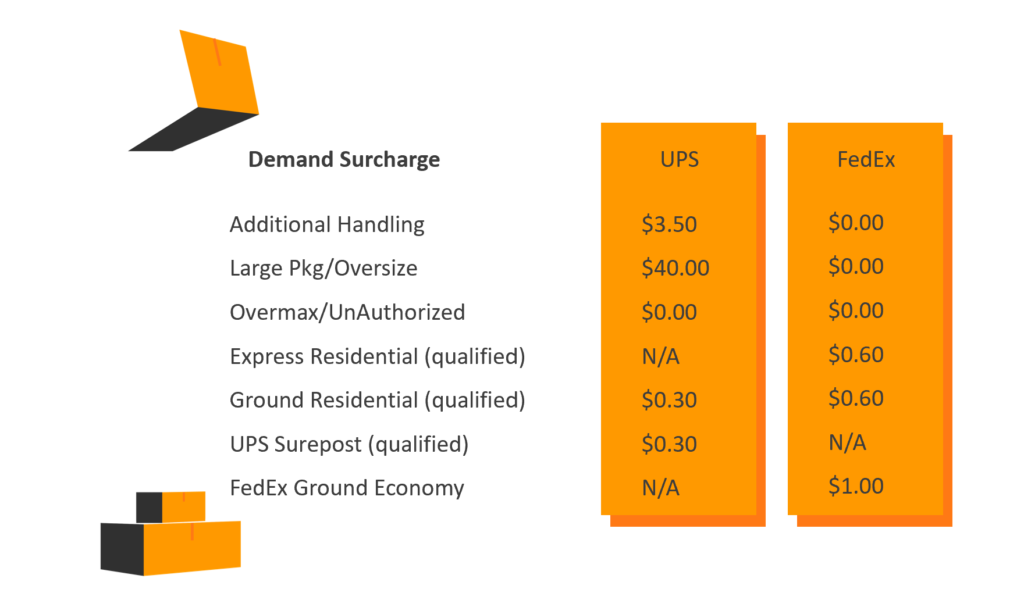

The Current Domestic “Demand” Surcharges

To set the stage, here are where many common surcharges stand right now.

Here’s What to Know About 2022 Holiday Season Peak Surcharges

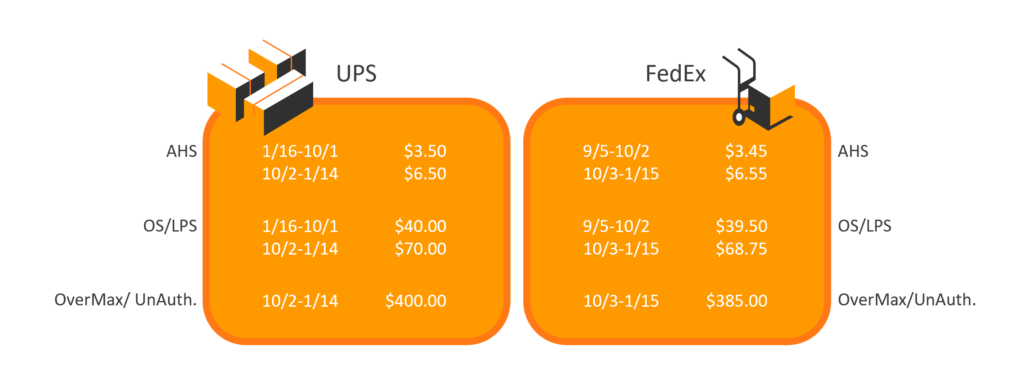

On August 5, 2022, FedEx first announced that it would reinstate holiday-season peak surcharges for the fifth year in a row, with UPS following on August 26. Again, while there are similarities between the carriers’ surcharges, there are also many contrasts that are important to understand.

The following illustration represents the current surcharge outlay through early January. This changed for FedEx effective September 5th and will change for UPS effective October 2nd. While FedEx penalized less bulky, awkward packages in 2022, UPS has offered an advantage in overall residential demand surcharges.

Comparing SurePost and Ground Economy

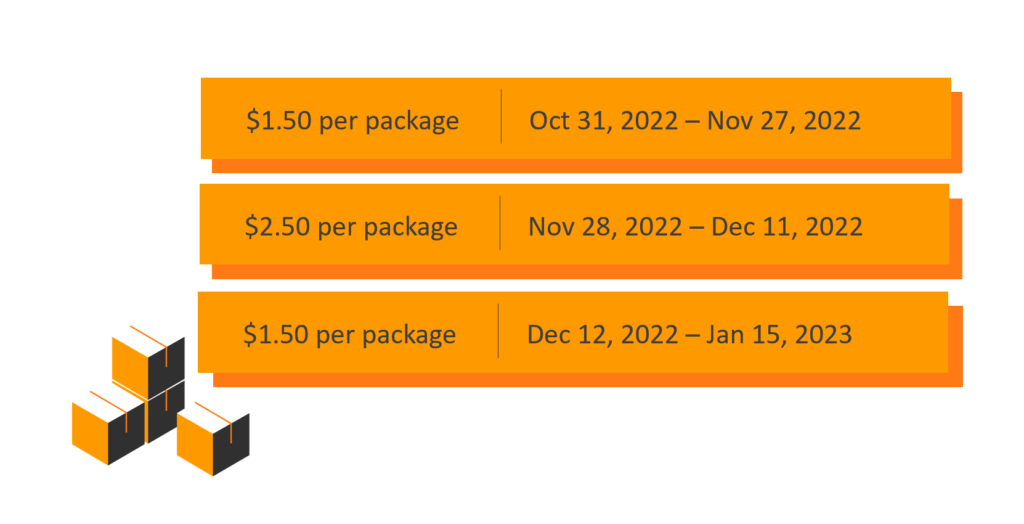

UPS is including its SurePost peak charges within its Residential peaking chart, while FedEx is increasing its current Delivery and Returns surcharges as follows. Residential Peak Surcharges:

Residential Peak Surcharges:

FedEx and UPS differ slightly in how their residential peak demand surcharges will be applied in 2022. While both carriers continue to focus these charges on larger-volume residential shippers, the past bar of 25,000 residential packages per week has been lowered to 20,000 per week.

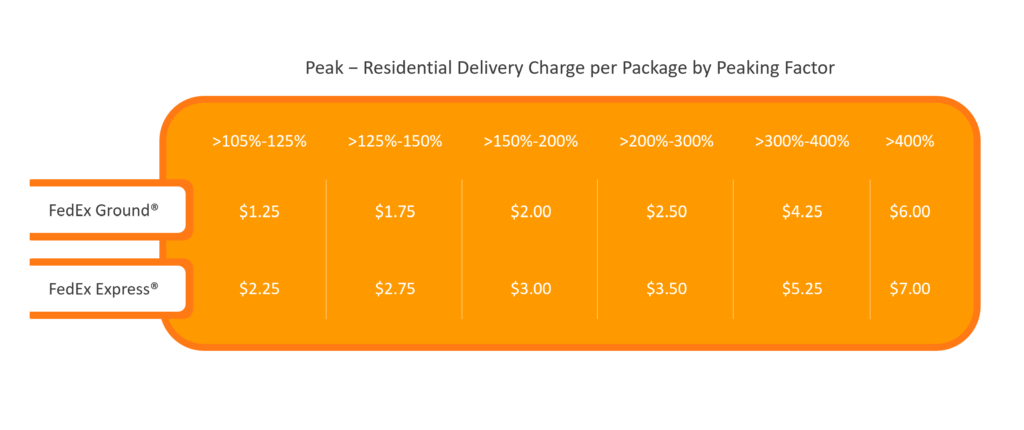

The “Peaking” factor tables from each carrier:

FedEx UPS

UPS

There are similarities in the timing and amounts charged, but one notable difference is that FedEx applies its charges based on the corresponding week. In contrast, once qualified, UPS shippers will be assessed fees for the remainder of the holiday season.

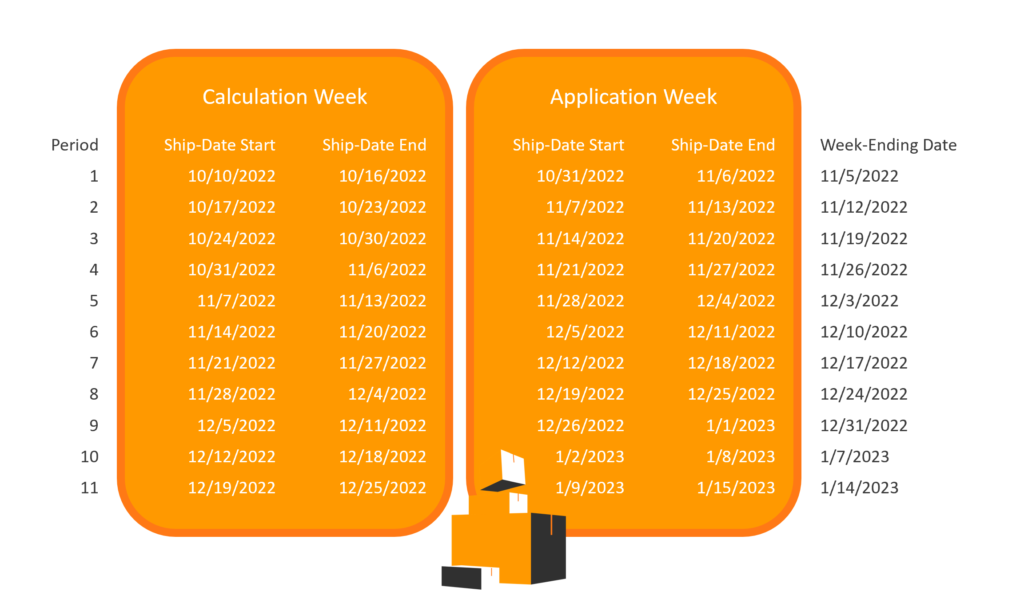

FedEx’s calculation table is below. June 2022 ship dates will define a shipper’s base. The spread above that average will be compared to the peaking table in the calculation week and charged during the application week.

UPS will also use June 2022 as the “baseline week.” The additional charges are assessed if a shipper is billed for more than 20,000 packages any week following October 2021. Or, if the company’s September 2022 shipping volume is less than 80% of its average weekly shipping volume during June of 2022, UPS will use September 2022 as the “baseline week.” These charges will be applied to EVERY package shipped with the respective service once a shipper is qualified and every week from 10/30/2022 to 1/14/2023.

What Shippers Should Do Next

Understanding the potential for additional costs outlined in this report is the first step to mitigating their impact. There is some more good news, however. The carriers are now more open to contract negotiation than they have been in some time. Notable is that UPS, for one, has returned to its pre-pandemic service levels. And both carriers are looking to enter peak season with full networks and on track to hit their 2023 revenue targets. TransImpact can assist you with your next contract negotiation and ensure you are well-prepared with data.

As always, the more command of your shipping operation you can illustrate when talking to FedEx and UPS, the better the result. TransImpact’s Demand Planning Software will help your company better forecast what’s to come for your peak season and beyond.

And, of course, the elephants in the room are the upcoming GRI announcements that our predictive analysis shows will be historically high. This is one more reason to act now and undertake a new parcel contract negotiation to avoid some of the impact of those inevitable increases.

Contact info@transimpact.com for a no-obligation analysis of how your parcel shipping costs will be impacted by the new peak demand surcharges and get our ideas for how to mitigate them.

Sources:

https://www.ups.com/assets/resources/webcontent/en_US/PeakDemandSurcharges_US.pdf

https://www.fedex.com/en-us/shipping/rate-changes/peak-surcharges.html