One not-so-subtle market condition that parcel supply chains

are dealing with is sky-high fuel surcharges. That, coupled with historic

inflation, has kept small package shipping budgets under severe stress after

two-plus years of sustained increases for other reasons we all know so

well.

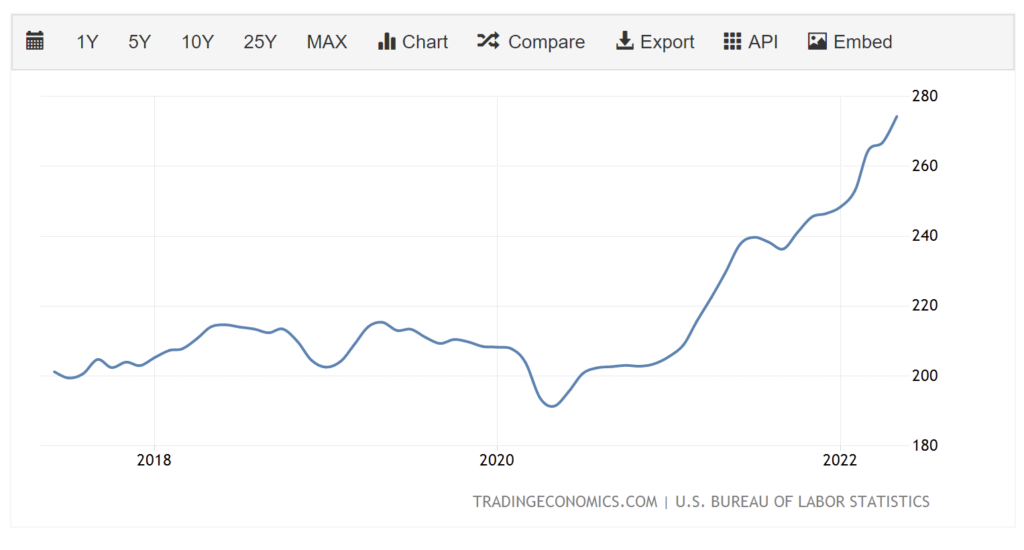

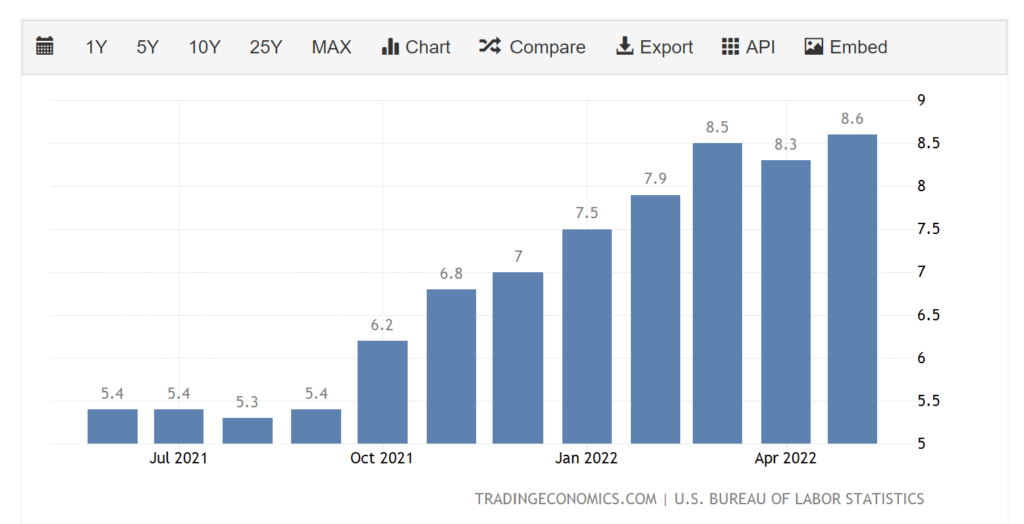

This chart of the U.S. Transportation CPI over the past five

years shows this trend clearly (with no sign of its softening in the short

term.)

U.S. Transportation CPI

Fuel and inflation are among the top reasons transportation costs are where they’re at today. A bigger problem is that both appear to be market conditions small parcel shipping carriers like FedEx® and UPS® are using to their advantage — making it all the more important for companies like yours to understand their impact.

Not coincidentally, TransImpact was founded during a period of financial distress (2008). That, too, was a period when carriers had an advantage over shippers, so these are not unfamiliar times from our perspective.

The State of Fuel Surcharges

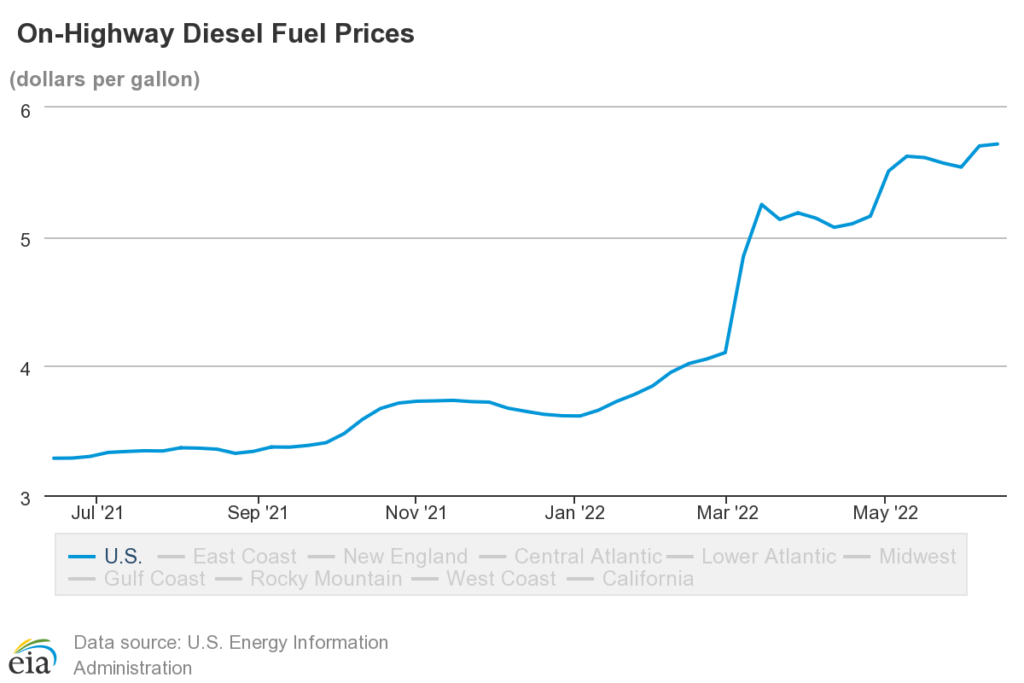

The rise in fuel costs since January 2022 has been significant, and it has translated into a steady rise in fuel surcharges.

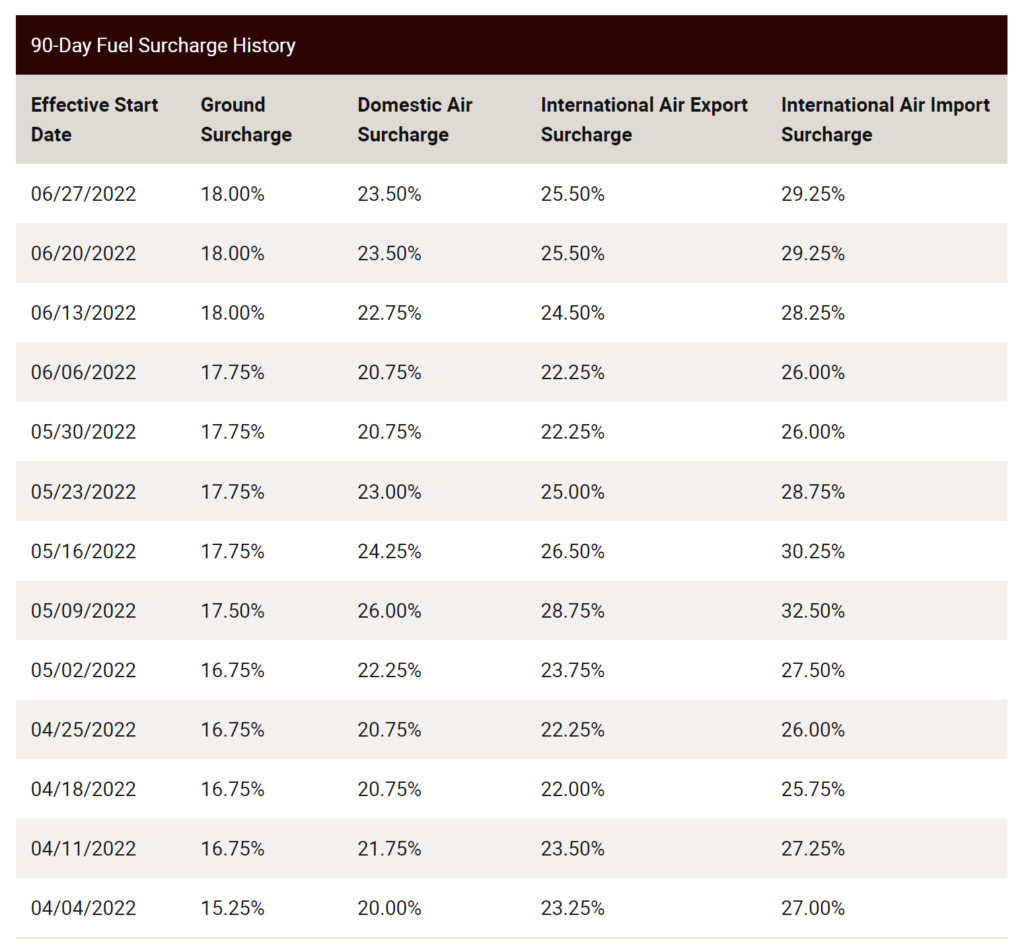

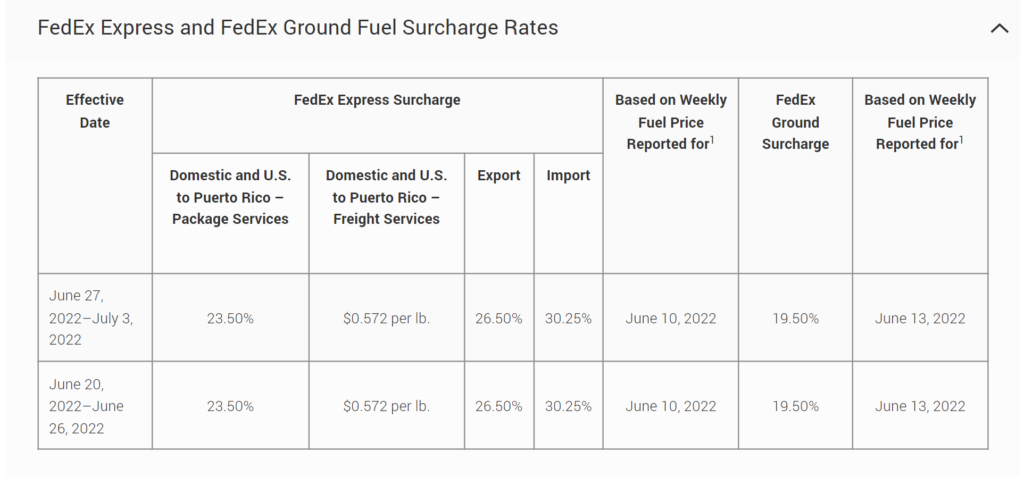

Both UPS’s and FedEx’s surcharges are at all-time highs. As of the end of June, the two carriers’ Air/Express fuel surcharges were equal (23.5%), with FedEx’s Ground, Import, and Export fuel surcharges slightly higher than UPS.

UPS 90-Day Fuel Surcharge History (week of June 27, 2022)

FedEx Fuel Surcharge Rates (week of June 27, 2022)

Don’t Overlook the Impact of Inflation, Either

While rising fuel costs may be a partial cause of inflation,

there are plenty of other factors driving up costs for most things in the U.S.

Also driving the higher expense of parcel shipping are a tight job market,

maintenance, real estate, warehouse rents, and equipment costs for logistics

services providers.

U.S. Monthly Rate of Inflation

Of course, the drivers of higher fuel costs and inflation are beyond any individual company’s ability to change. But, there are things you can do to minimize their effect.

Doing Something About It

While the causes of supply chain pain are apparent to most of us, knowing what to do about it may not be. Here are four suggestions:

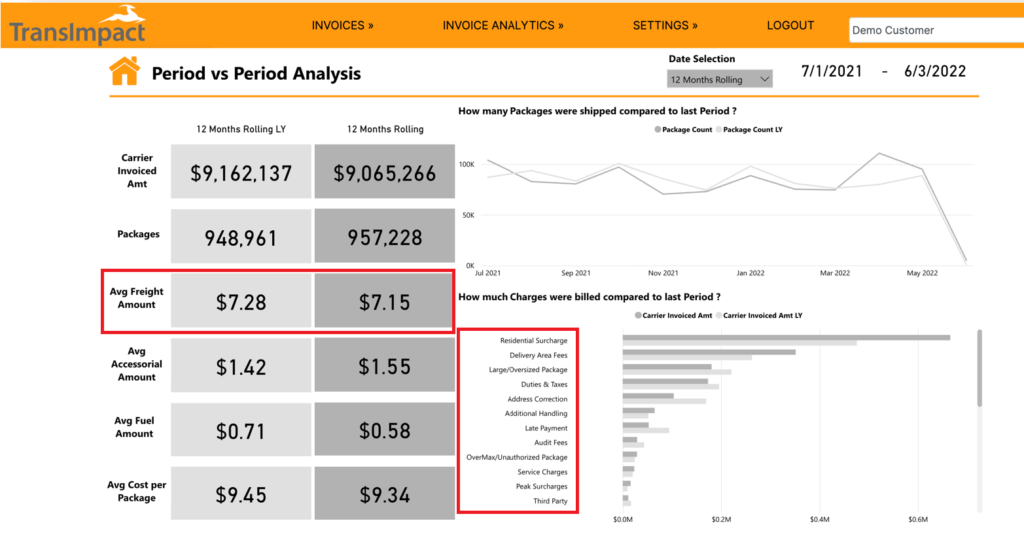

1. Dig into your data for insights – Fuel surcharges in the 20% range likely make it the second largest line item on your parcel invoices after the base rate. Smart shippers are using data to really understand how much changes in fuel prices are impacting their budgets. Fuel surcharges are also often misbilled, so auditing your invoices for accuracy is a must. (See the screenshot below for an example of TransImpact’s Parcel Spend Intelligence™ dashboard view.)

2. Diversify your carriers – It is vital to be tactical with a multi-carrier strategy because carriers’ fuel surcharge tables are not the same. The charts above show that carrier surcharges depend on the type of shipment and often differ between UPS and FedEx. Make sure the CURRENT fuel cost is figured into your estimated costs when determining which carrier to use.

3. Look deeper to find other savings – While fuel surcharges may be inevitable right now, don’t assume the other line items on your invoice are. Other surcharges, fees, and accessorials can still add up to a lot. So, taking steps to minimize those extra costs is still important. BTW, these are also costs you can bring to light by looking at your data. (See the screenshot below)

4. Use the present as an opportunity – The parcel shipping marketplace is at an inflection point. Carriers and companies like yours have dealt with changing conditions for years, but things appear to be settling. Now is a great time for a new agreement with FedEx and UPS. Talk to TransImpact, and our experts can assist you with a parcel contract negotiation strategy that fits your needs, right now.

Visit TransImpact.com

to learn how the power of BI and data analytics can enable your company to

minimize the cost impact of fuel surcharges and inflation.